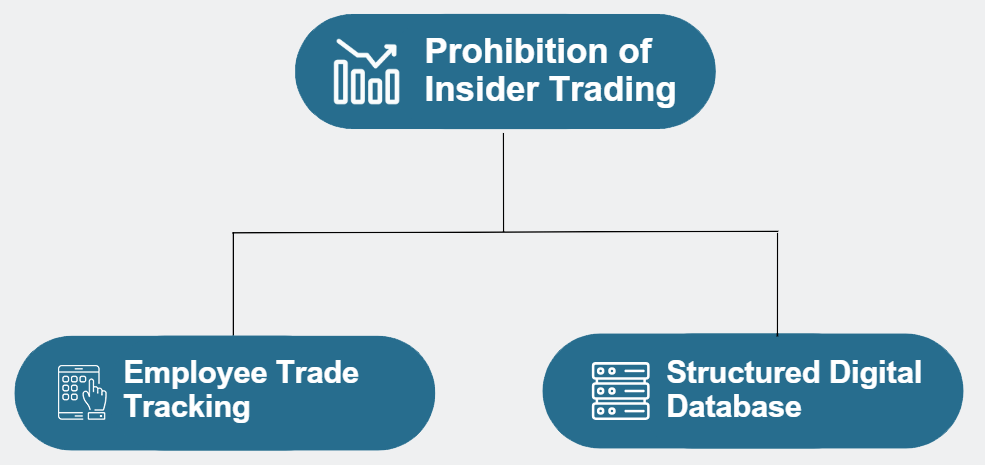

Over the last 7 years, our relationship with TrackWizz has been growing. It began with Anti Money Laundering and we use now more than 7 modules in areas of insider trading and KYC. Their approach of continuously improving the solution in this ever-changing landscape of financial services is their biggest strength. The integration of modules in a single software has also helped to achieve savings of cost and resources.

TrackWizz is a genuine partner for our compliance and operations requirements.