TrackWizz Screening TrackWizz Screening is a tool/ software solution specially designed for:

- Banks

- Lending Business/ Non Banking Finance Company (NBFC)/ Housing Finance Company (HFC)

- Capital Market Institution/ Stock Broker/ Commodity Broker

- Asset and Wealth Management firm

- Insurance Company

- Listed Company

- Alternative Investment Fund

- Any other organization wanting to do sanctions check/ background check.

- CA/ CS/ Gems & Jewellers/ Gaming/ Gambling/ Real Estate/ Law Firms

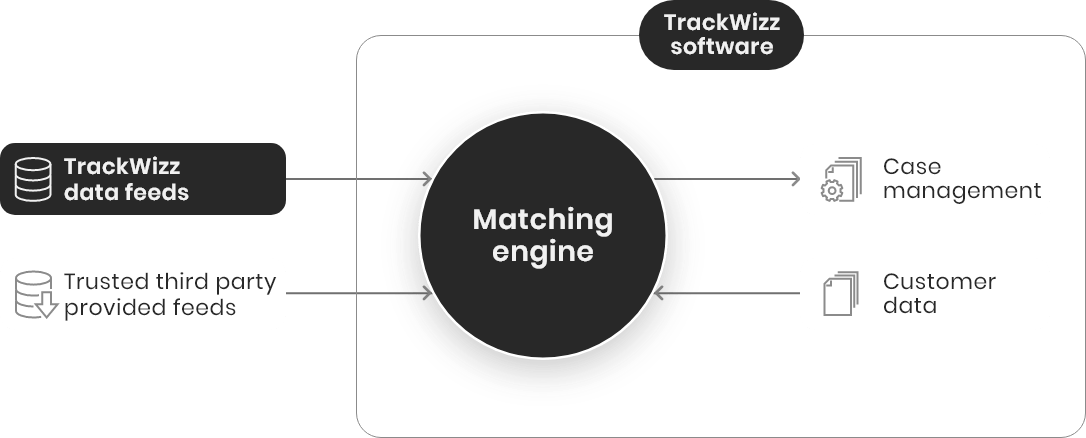

TrackWizz Screening assists Institutions to be compliant with name screening also known as sanctions screening or AML check regulation of Prevention of Money Laundering Act (PMLA).The solution comes with a combination of sophisticated matching engines and TrackWizz provided 120+

watchlist feeds which consists of but not limited to:

- International & domestic sanctions (UAPA, UNSC, OFAC,...)

- Regulatory feeds (RBI List, IRDA List, SEBI Debarred List, NHB)

- Watchlist provided by statutory bodies

- Watchlist provided by stock exchanges

- Politically Exposed Person (PEP)

In addition to TrackWizz provided feeds, our partnership with refinitiv (previously known as world check) makes a comprehensive screening software. The offering is available on premise and as a cloud based service (software as a service).