One stop solution

It allows you to add other modules like Screening & Risk Rating, reducing multiple system complexityBreadth & depth

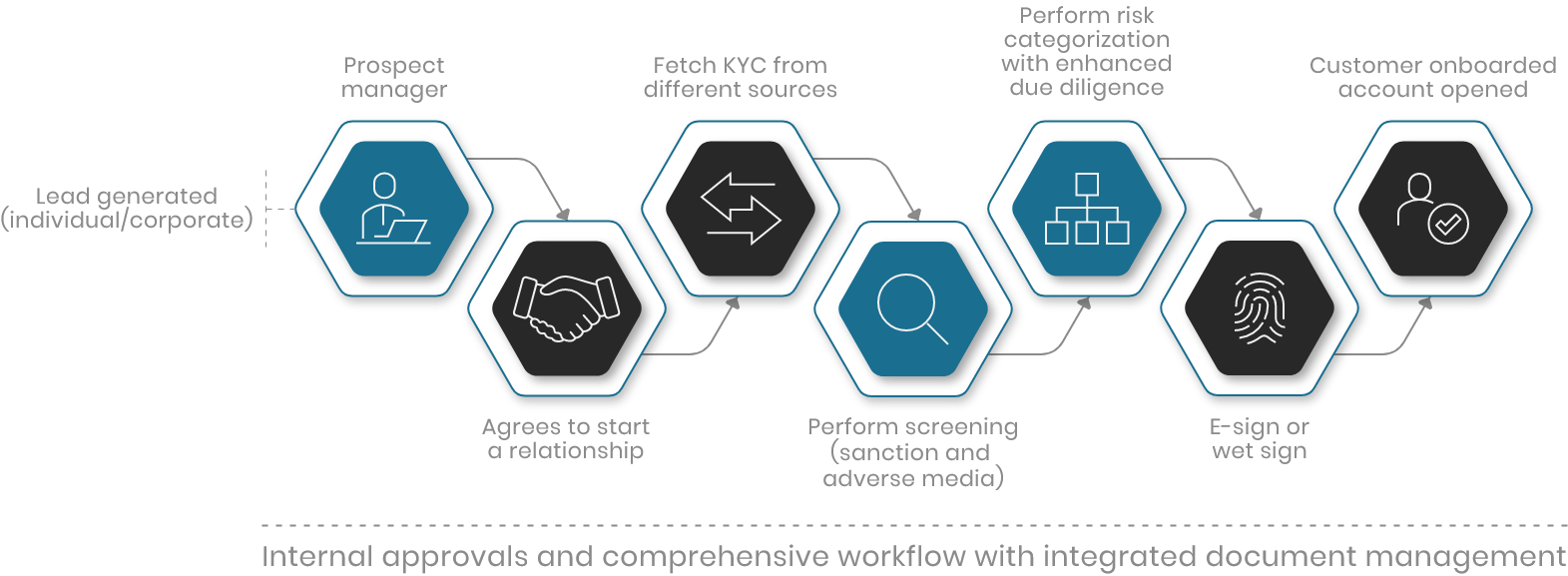

Covers multiple lines of business along with products and facilitates deep KYC profiling of the clientDefinite destination

Starts with prospect management by bankers and goes till commencement of business by creation of account numbers in product systemsIntelligent checklist

Entity onboarding varied documentation requirements is responsibility of the system freeing up key resourcesVideo KYC & e-sign

Sophisticated architecture allows easy integration with external partners for video based KYC and e-signatureMDM & CIS

Unique customer code and information maitained here along with supporting documents acting as a central source for customer information and imagesDeferral management

Access on need

Document generation with ease

Image manager

Your needed controls

Serve existing customers for new

System based deferral management means no more tracker on spreadsheets or human triggered email reminders

Multiple methods of access controls like relationship manager, banker, branch or regional access using privilege management

System allows generation of proposal/account opening forms, modification forms and other templates based on institutional needs with customized templates

Facilitates extraction of specific information or portions from large images or documents often saving hours of effort of KYC teams

A parameterized validation engine means that you can pick and choose the data validations or controls that are needed by your institution

Allows for autofill of information for instant onboarding of existing customers for new products

Combining the TrackWizz Customer Onboarding with the modules mentioned below, results in extreme savings